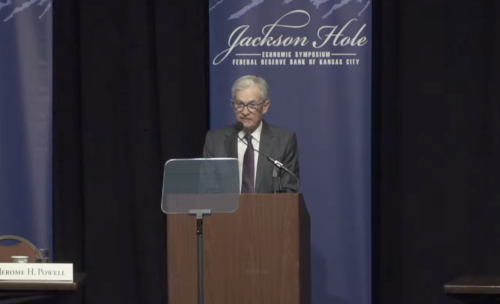

U.S. Federal Reserve Chair Jerome Powell made alluded to some promising promises in his latest speech. Powell appeared Friday to open the door to the central bank’s first rate cut of President Donald Trump’s second term as the Federal Reserve chair indicated that current monetary policy may be restricting economic activity.

Appointed initially in 2018, Powell has guided the Fed through significant challenges, including high inflation and economic uncertainty following the COVID-19 pandemic. His leadership focuses on balancing inflation control with supporting employment and overall economic stability.

READ: Here’s why the Fed should cut 50 basis points in September (August 22, 2025)

In a closely watched speech at the Fed’s annual symposium in Jackson Hole, Wyoming, Powell said the labor market was now in a “curious kind of balance” resulting from lowering hiring and decreasing availability of workers amid Trump’s immigration crackdown and demographic changes.

But overall, “downside risks to employment are rising,” Powell said. “And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.”

“Today’s speech could not be more clear that Powell is ready to cut rates on September 17th and the market is now fully priced for it and for a 2nd one by year end,” Peter Boockvar, an independent economist and market strategist wrote in a note following Powell’s speech.

“Core inflation is still stubborn and the labor market, while showing some signs of cooling, isn’t screaming for emergency intervention,” Kevin Ford, strategist at Convera financial group, wrote in a note to clients. “This disconnect is what makes Powell’s speech a high-stakes event.”

Trump has repeatedly criticized Powell for maintaining higher interest rates, which he argued were hurting the economy, housing market, and business growth. This vocal criticism reflects Trump’s ongoing frustration with what he saw as overly cautious Fed policies that could slow economic recovery. Despite the pressure, Powell remains firm on the Fed’s commitment to data-driven decision-making, emphasizing that interest rate moves must be based on inflation trends and labor market conditions, not political demands.

In February, the administration issued Executive Order 14215, requiring independent agencies, including the Federal Reserve, to consult with the White House on significant regulations. Although interest rate decisions were exempted, the order raised concerns about potential political influence on the Fed’s broader operations. Powell consistently defended the central bank’s autonomy, stressing the importance of independence to effectively manage inflation and employment.

This friction between Trump and Powell highlighted the broader challenge of balancing political pressures with the Federal Reserve’s role as an independent economic steward during a period of post-pandemic uncertainty.

The coming months will be critical in defining the trajectory of U.S. monetary policy and political-economic balance.