A group representing major automakers warned that a chip disruption caused by a dispute between the Chinese and Dutch governments could impact U.S. production. Nexperia told carmakers and their suppliers last week that it could no longer guarantee delivery of its chips, according to ACEA, the European Union’s auto association, which also said manufacturing could be significantly disrupted.

In the U.S., the Alliance for Automotive Innovation, which represents General Motors, Toyota, Ford, Volkswagen, Hyundai and nearly all other major automakers, urged a quick resolution. “If the shipment of automotive chips doesn’t resume – quickly – it’s going to disrupt auto production in the U.S. and many other countries and have a spillover effect in other industries,” said the group’s CEO John Bozzella. “It’s that significant.”

READ: Stellantis unveils $13 billion US investment (

Some automakers also told Reuters that U.S. auto plants could be affected as soon as next month. The chips made by Nexperia are crucial to production of U.S. parts and vehicles.

The Dutch government had said on Sunday that it had, as of Sept. 30, taken control of the Chinese-owned computer chipmaker. The Dutch government’s move came following rising pressure from the U.S. Nexperia was at risk of being impacted by a new U.S. rule that extends export control restrictions to companies at least 50% owned by one or more entities on the U.S. entity list.

This comes amid growing tensions between China and the West over the development of technology such as computer chips and semiconductors, which are essential components for the manufacture of artificial intelligence technology. The Dutch government had cited concerns about the possible transfer of technology to Nexperia’s Chinese parent company, Wingtech.

READ: Apple pledges another $100 billion investment in US manufacturing (

The Chinese commerce ministry issued an export control notice on Oct. 4, which prohibited Nexperia China and its subcontractors from exporting specific finished components and sub-assemblies manufactured in China according to a statement published by the company on Tuesday. Volkswagen and BMW both said production in Europe had not yet been impacted by the issues but that they were working to identify potential supply risks.

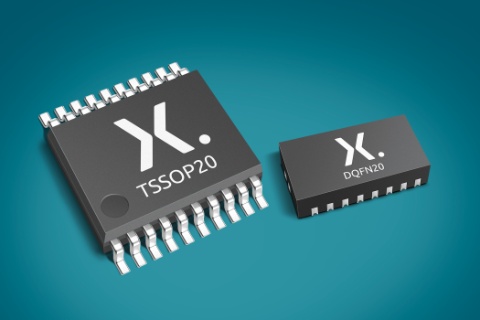

Ian Riches, a vice president at TechInsights, said that while Nexperia is a small player in the automotive-chip market overall, it is the market leader for a basic category of chips mainly consisting of transistors and diodes. In that category, Nexperia has about a 40% market share, he added.

“They go into everything and anything,” Riches said. “If you’re building a complicated product, it only takes a shortage of one basic component to stop the whole thing.”