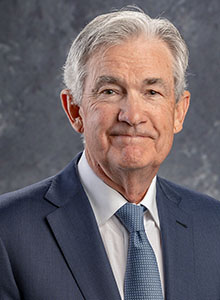

US President Donald Trump’s feud with Federal Reserve Chair Jerome Powell is causing the market quite a bit of trouble. Reportedly, the dollar and Wall Street futures dropped and gold jumped on Monday as Powell said the Trump administration had threatened him with a criminal indictment over the refurbishment of the central bank’s headquarters.

“This unprecedented action should be seen in the broader context of the administration’s threats and ongoing pressure,” Powell, whose term is due to end in May, said in a statement.

Reportedly, this escalated worries about the Fed’s independence from political influence to a new level and added to a frenetic start to 2026, which has already seen the U.S. capture Venezuela’s Nicolas Maduro and ramp up talk of taking control of Greenland.

READ MORE: Zohran Mamdani stuns Cuomo in NYC Democratic mayoral primary (June 25, 2025)

“Trump is pulling at the loose threads of central bank independence,” said Andrew Lilley, chief rates strategist at Barrenjoey, an investment bank based in Sydney.

“Investors won’t be happy about it, but it shows actually Trump has no other levers to pull. The cash rate will stay what the majority of the FOMC wants them to be.”

Reportedly, the dollar had the sharpest reaction, falling even against typically risk-sensitive currencies like the Australian and New Zealand dollars.

“This open warfare between the Fed and the U.S. administration … it’s clearly not a good look for the U.S. dollar,” said National Australia Bank’s head of currency strategy, Ray Attrill.

The ongoing clash between the executive branch and the Federal Reserve underscores the delicate balance between political authority and independent monetary governance. Central banks operate on credibility, and perceptions of political interference can have far-reaching consequences for investor confidence, market stability, and economic expectations.

The recent episode highlights how tensions at the highest levels of government can reverberate through domestic and global financial systems, influencing not only currency valuations but also investment flows, risk appetite, and broader asset allocation decisions.

“With the Fed’s independence now openly contested, the ‘political risk’ discount usually reserved for emerging markets is bleeding into the U.S. dollar, driving investors toward hard assets,” said Zain Vawda, analyst at MarketPulse by OANDA.

Financial markets are particularly sensitive to uncertainty, and episodes that challenge institutional independence often amplify volatility beyond what fundamental economic conditions might justify.

Even short-term disagreements or threats can shape market sentiment, altering the behavior of corporations, banks, and households in ways that affect credit, liquidity, and growth prospects. How investors, central banks, and international partners respond to these developments over the coming months remains uncertain, and the cumulative effect on confidence in U.S. monetary policy is difficult to predict.

This situation also illustrates the broader tension between short-term political objectives and long-term institutional stability. The potential ramifications for economic planning, regulatory frameworks, and fiscal-monetary coordination are unclear, leaving policymakers with the challenge of managing both domestic and international perceptions.

Ultimately, the episode serves as a reminder that the independence of central banking is not only a technical matter but a cornerstone of trust in financial and economic governance, the protection of which is critical to sustaining stability in complex, interconnected markets.