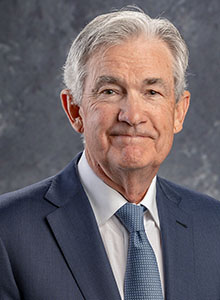

It appears that central banks around the world are rallying behind U.S. Federal Reserve Chair Jerome Powell amid his public feud with U.S. President Donald Trump. The chiefs of several of the world’s major central banks issued a rare joint statement on Tuesday backing Powell after the Trump administration threatened him with a criminal indictment.

“We stand in full solidarity with the Federal Reserve System and its Chair Jerome H. Powell,” the central bankers said in the statement.

“The independence of central banks is a cornerstone of price, financial and economic stability in the interest of the citizens that we serve.”

“It is therefore critical to preserve that independence, with full respect for the rule of law and democratic accountability,” the group added.

READ: Trump threatens to sue Federal Reserve Chair Jerome Powell for incompetence (December 30, 2025)

The heads of the European Central Bank, the Bank of England, the Bank of Canada, and eight other institutions said Powell had acted with integrity and emphasized that central bank independence is essential to maintaining stable prices and financial markets.

In early 2026, tensions between Trump and Powell escalated into one of the most serious confrontations over central bank independence in decades. The conflict centers on Trump’s long-standing frustration with the Federal Reserve’s refusal to cut interest rates more aggressively, which he argues has constrained economic growth.

The dispute intensified after the U.S. Justice Department opened an investigation into Powell related to his congressional testimony on the Federal Reserve’s headquarters renovation project. Trump has publicly criticized Powell’s leadership and suggested he would consider replacing him when Powell’s term ends in May 2026. Powell has denied any wrongdoing and has defended the Fed’s independence.

Central banks are entrusted with the delicate responsibility of balancing inflation, employment, and the overall health of the financial system. Their credibility depends on the perception that policy decisions are driven by economic data rather than political pressure. When that independence is threatened, it can unsettle markets, undermine confidence in monetary policy, and send shockwaves through the global financial system.

The strong, coordinated support Powell has received from central banks worldwide underscores a shared understanding among policymakers that protecting institutional autonomy is essential not only for national economies but for the global economic order. The show of solidarity sends a clear signal that the international financial community values rule-based governance and expects central banks to operate with integrity, free from partisan influence.

READ MORE: Zohran Mamdani stuns Cuomo in NYC Democratic mayoral primary (June 25, 2025)

Beyond economics, the episode highlights a broader principle: democratic institutions function best when power is constrained and responsibilities are clearly defined. How political leaders engage with independent agencies can set lasting precedents for governance, public trust, and systemic stability. The outcome of this dispute is likely to shape confidence in monetary policy and institutional resilience for years to come.

Powell’s defense by central bankers also reflects how deeply interconnected modern economic governance has become, with actions in one country resonating far beyond its borders.

Ultimately, the episode serves as a reminder that strong institutions depend not only on legal frameworks, but also on norms, accountability, and the willingness of leaders and stakeholders to respect boundaries—ensuring decisions are made in the public interest rather than for short-term political advantage.