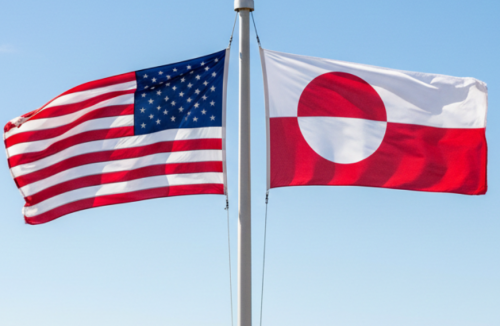

U.S. President Donald Trump’s threats of taking over Greenland have made many countries uneasy, and the fallout is increasingly spilling into financial and diplomatic arenas. Reportedly, nations in Trump’s crosshairs have found few ways to push back against a president who appears dug in on owning Greenland, patrolling the Western Hemisphere, and pressuring Europe. One source of leverage they do have, Bridgewater founder Ray Dalio told Semafor’s Liz Hoffman, is significant holdings of U.S. debt.

“You could easily imagine it could simply become unpopular to buy or hold US debt,” Dalio said. (The hedge-fund founder promptly urged the audience to buy gold.)

Reportedly, Dalio said the roughly $9 trillion in U.S. debt owned by foreign countries is an “enormous vulnerability,” speaking at Semafor Haus in Davos.

READ: Europe pushes back as Trump threatens new tariffs over Greenland (

The U.S. government, however, has projected confidence despite the warnings. “Denmark’s investment in U.S. Treasury bonds, like Denmark itself, is irrelevant,” U.S. Treasury Secretary Scott Bessent told reporters at Davos on Wednesday.

Reportedly, the “sell America” trade was in full swing Tuesday after Trump and European leaders escalated tensions over Greenland. U.S. stocks and bond prices tumbled, sending yields spiking.

What is the “Sell America” trade?

The “Sell America” trade refers to a pattern in financial markets where investors reduce exposure to U.S. assets in response to political, economic, or geopolitical uncertainty. It is not an official term but is widely used in market commentary to describe how shocks—such as trade disputes, tariffs, or diplomatic tensions—can prompt large-scale selling of U.S. stocks, bonds, and sometimes the dollar. When triggered, investors move capital out of U.S. equities, causing stock indexes to fall, and sell government bonds, which pushes yields higher. Foreign investors may also shift funds to other markets perceived as safer. This reaction reflects a combination of risk management and sentiment: uncertainty about U.S. policy or stability makes holding U.S.-denominated assets less attractive. While often temporary, the “Sell America” trade can amplify market volatility and influence broader economic conditions, including consumer confidence and global trade flows, highlighting the interconnectedness of policy decisions and financial markets.

Bessent also invoked past U.S. strategic thinking in defending Washington’s posture. He noted that the United States bought the U.S. Virgin Islands from Denmark during World War I because leaders at the time “understood” the islands’ importance.

“President Trump has made it clear that we will not outsource our national security or our hemispheric security to any other countries,” Bessent said. “Our partner, the U.K., is letting us down with the base on Diego Garcia, which we had shared together for many, many years, and they want to turn it over to Mauritius. So, President Trump is serious here.”

“Just as I said after liberation day last year, I would tell everyone, ‘take a deep breath, do not have this reflexive anger that we’ve seen, and this bitterness.’ Why don’t they sit down and wait for President Trump to get here and listen to his argument, because I think they are going to be persuaded.”

More broadly, the episode highlights how geopolitical tension can quickly intersect with financial markets and perceptions of stability. When a major economy signals assertive—or unpredictable—policy, investors often reassess risk, translating into volatility across equities, bonds, and currencies. Such responses underscore the tight link between economic and political decision-making, where actions involving territorial disputes, defense priorities, or diplomatic posturing can ripple through markets worldwide.

READ: Shoot or sale?: Trump weighs paying Greenland residents as US–Denmark Arctic tensions escalate (

The situation also illustrates how perceptions of national strategy, security, and credibility shape international behavior. Even when official messaging aims to reassure allies or calm markets, uncertainty can persist, prompting cautious responses from investors and foreign governments alike.

Ultimately, these dynamics are a reminder that leadership decisions are closely watched not only for immediate political impact but also for broader economic and financial consequences. Market reactions, foreign investment behavior, and international confidence are all influenced by perceived stability, consistency, and predictability in policy.